Introduction

Small businesses are the backbone of our economy and play a vital role in supporting local communities. However, running a small business can be challenging, especially when it comes to accepting payments. Traditional payment methods such as cash and check can be time-consuming and insecure, while credit card processing can be costly and complex. This is where a payment solution comes in.

A payment solution is a service that enables small businesses to easily and securely accept payments from customers. This can include online payments, mobile payments, and in-person payments, depending on the solution. Some popular payment solutions for small businesses include Square, PayPal, and Stripe.

By implementing a payment solution, small businesses can benefit from increased efficiency, improved security, enhanced customer experience, cost savings, and more. In this blog, we will explore these benefits in more detail and provide insights on how small business owners can choose and implement a payment service that best fits their needs.

It’s important to note that a payment solution can help small businesses to enhance their customer experience by allowing them to accept multiple forms of payment in one place, also it allows them to process transactions faster and more securely than traditional methods, this can be a significant advantage in today’s fast-paced business environment where customers expect convenience and speed.

In summary, a payment solution can be a valuable tool for small businesses looking to improve their operations and better serve their customers. By providing a convenient and secure way to accept payments, payment service can help small businesses save time, increase revenue, and grow their customer base.

Top 11 Benefits Of Using A Payment Solution For Small Businesses

1. Increased Efficiency

One of the main benefits of using a payment solution for small businesses is increased efficiency. By streamlining the process of accepting payments, payment services can save small business owners valuable time and resources.

For example, instead of manually processing cash and check payments, a payment solution allows small businesses to quickly and easily accept payments through various methods such as credit cards, debit cards, or digital wallets. This eliminates the need for small business owners to manually enter payment information and reduces the risk of errors and discrepancies.

Moreover, a payment solution can also help small businesses to automate their invoicing and record-keeping process. This can save a lot of time, and also eliminates the need for manual data entry, reducing the risk of errors and freeing up time for small business owners to focus on other aspects of their business.

Additionally, a payment solution can also provide small businesses with real-time data and analytics, this can help them to track sales, monitor customer behavior, and identify patterns, which can help the business to make more informed decisions and improve the overall efficiency of the business.

In summary, by providing small businesses with a simple, efficient, and secure way to accept payments, a payment solution can help small business owners save time, increase productivity and focus on other aspects of their business. This can help them to grow their customer base, increase revenue and improve their bottom line.

2. Improved Security

Another benefit of using a payment solution for small businesses is improved security. Traditional payment methods, such as cash and check, can be vulnerable to theft, fraud, and other types of criminal activity. Credit card processing also poses security risks, as small businesses must comply with strict regulations and protect sensitive customer information.

A payment solution can help small businesses to mitigate these risks by providing advanced security features. For example, many payment services use encryption and tokenization to protect sensitive customer information. Additionally, many payment solutions are PCI compliant, meaning that they have been certified to meet the security standards set by the Payment Card Industry Data Security Standards (PCI DSS).

Moreover, a payment solution can also help small businesses to detect and prevent fraud. For example, it can use machine learning algorithms to detect suspicious activity and flag potential fraud. Additionally, it can also provide small businesses with tools such as fraud filters, which can help to prevent fraudulent transactions from being processed.

In summary, by providing small businesses with advanced security features, a payment solution can help them to protect sensitive customer information, comply with regulations and prevent fraud. This can help small businesses to avoid costly security breaches, reduce their liability and improve their reputation.

3. Enhanced Customer Experience

A payment solution can also help small businesses to enhance the customer experience. By providing customers with a variety of payment options, payment services can make it easier and more convenient for them to make purchases. This can lead to increased customer loyalty and repeat business.

For example, a payment solution can allow small businesses to accept payments through various methods such as credit cards, debit cards, digital wallets, and even cash. This can provide customers with more flexibility and convenience, as they can choose the payment method that best suits their needs.

Additionally, a payment solution can also help small businesses to process transactions faster and more securely than traditional methods, which can lead to a more positive customer experience. For example, customers no longer have to wait in long lines to pay for their purchases, which can save them time and improve their overall satisfaction with the business.

Furthermore, payment service can also provide small businesses with the ability to create and manage a customer database, this can help them to personalize their customer service, keep track of customer preferences, and even offer loyalty programs. This can help to build customer loyalty, which can lead to repeat business and increased revenue.

In summary, by providing customers with a variety of payment options, faster and more secure transactions, and personalized customer service, a payment solution can help small businesses to enhance the customer experience, which can lead to increased customer loyalty and repeat business.

4. Cost Savings

Another benefit of using a payment solution for small businesses is cost savings. Traditional payment methods, such as cash and check, can be costly to process and manage. Credit card processing can also be expensive, as small businesses must pay transaction fees and comply with regulations.

A payment solution can help small businesses to save money in the long run by providing a more cost-effective way to accept payments. For example, many payment solutions charge lower transaction fees than traditional credit card processors. Additionally, many payment solutions also offer flat rate pricing, which can provide small businesses with predictable costs and help them to budget more effectively.

Moreover, a payment solution can also help small businesses to save money on equipment and supplies. For example, a small business that uses a mobile payment solution can eliminate the need to purchase a traditional credit card terminal, which can save them a significant amount of money.

Additionally, a payment solution can also help small businesses to save money on accounting and record-keeping expenses. For example, by automating the invoicing and record-keeping process, a payment solution can reduce the need for manual data entry, which can save small businesses money on labor costs.

In summary, by providing small businesses with a cost-effective way to accept payments, a payment solution can help them to save money on transaction fees, equipment and supplies, and accounting and record-keeping expenses. This can help small businesses to improve their bottom line and increase their revenue.

5. Increased Flexibility

A payment solution can provide small businesses with the flexibility to accept payments from customers in various ways, including online, in-person, and on the go. This can help small businesses to reach a wider customer base and sell their products or services in a variety of settings.

One way a payment solution can increase flexibility is through the ability to accept online payments. This allows customers to make purchases at any time and from any place, which can be especially beneficial for small businesses that operate in niche markets or have a limited physical presence. For example, a small business that sells handmade candles can use an online payment solution to accept payments from customers who find their products on their website, which can help to increase sales and reach a wider customer base.

Another way a payment solution can increase flexibility is through the ability to accept in-person payments. This can be done through traditional point-of-sale terminals or mobile devices, which allows small businesses to process payments at events, pop-up shops, and other physical locations. For example, a small business that rents out photo booths for events can use a mobile payment solution to accept credit card payments directly from customers, which can help to increase sales and reach a wider customer base.

Finally, a payment solution can increase flexibility by allowing small businesses to accept payments on the go. This can be done through mobile devices and can be especially beneficial for small businesses that have a mobile workforce or operate remotely. For example, a small business that provides a delivery service can use a mobile payment solution to accept payments from customers through their mobile app, which can increase customer convenience and satisfaction.

In summary, a payment solution can provide small businesses with increased flexibility in the ways they can accept payments from customers. This can help small businesses to reach a wider customer base and sell their products or services in a variety of settings, which can ultimately help them to grow their business.

6. Improved Cash Flow

A payment solution can help small businesses to improve their cash flow by providing faster and more secure payment processing. This can be particularly beneficial for small businesses that operate on a tight budget or have limited access to credit.

One way a payment solution can improve cash flow is by providing faster payment processing. For example, a payment solution that uses mobile devices or virtual terminals can allow small businesses to process payments quickly and efficiently, which can speed up the time it takes for customers to pay and for the small business to receive payment. This can help small businesses to have a more predictable cash flow, which can be beneficial for budgeting and planning.

Another way a payment solution can improve cash flow is by providing more secure payment processing. By using advanced security features, such as encryption and tokenization, a payment solution can help to protect sensitive customer information and prevent fraud. This can help small businesses to avoid costly security breaches, which can negatively impact their cash flow. Additionally, by providing small businesses with tools to detect and prevent fraud, a payment solution can help them to avoid chargebacks, which can also negatively impact their cash flow.

In summary, by providing small businesses with faster and more secure payment processing, a payment solution can help to improve their cash flow. This can be particularly beneficial for small businesses that operate on a tight budget or have limited access to credit, as it can help them to have a more predictable cash flow,

7. Better Inventory Management

Some payment solutions provide small businesses with inventory management tools, which can help them to better manage their stock levels and make informed purchasing decisions. This can ultimately help small businesses to reduce waste, avoid stockouts, and improve their bottom line.

One way a payment solution can provide better inventory management is by giving small businesses real-time visibility into their stock levels. This can be done through integration with point-of-sale systems or through inventory management software. This can help small businesses quickly identify when they need to reorder products or adjust their inventory levels.

Another way a payment solution can provide better inventory management is by providing small businesses with detailed reporting on their sales and stock levels. This can help small businesses identify which products are selling well and which are not, which can help them to make informed purchasing decisions. Additionally, it can also help small businesses to identify patterns in their sales, such as seasonal trends, which can help them to better plan their inventory levels.

In addition, some payment solutions also provide small businesses with the ability to create purchase orders and track their expenses, this can help small businesses to keep track of their expenses, and also make sure they are not overstocking items that may not be selling well.

In summary, by providing small businesses with inventory management tools, a payment solution can help them to better manage their stock levels and make informed purchasing decisions. This can help small businesses to reduce waste, avoid stockouts and improve their bottom line, which can ultimately help them to grow their business.

8. Scalability

A payment solution can help small businesses to scale their operations as they grow. This can be particularly beneficial for small businesses that have the potential to expand their business and reach a wider customer base.

One way a payment solution can provide scalability is by providing small businesses with tools to manage multiple locations. This can be done through integration with point-of-sale systems, inventory management software, or other business tools. This can help small businesses to keep track of their inventory levels and sales across multiple locations, which can be especially beneficial for small businesses that operate in multiple cities or states.

Another way a payment solution can provide scalability is by providing small businesses with tools to manage multiple employees. This can be done through employee management tools, time tracking, and scheduling tools. This can help small businesses to keep track of their employee hours, schedules, and sales across multiple employees, which can be especially beneficial for small businesses that have a large number of employees.

Finally, a payment solution can provide scalability by providing small businesses with tools to manage multiple sales channels. For example, a payment solution can provide small businesses with the ability to sell their products or services through their website, mobile app, or social media channels. This can help small businesses to reach a wider customer base and increase their sales, which can be especially beneficial for small businesses that operate in niche markets or have a limited physical presence.

In summary, by providing small businesses with tools to manage multiple locations, employees, and sales channels, a payment solution can help them to scale their operations as they grow. This can help small businesses to expand their business more easily and reach a wider customer base, which can ultimately help them to grow their business.

9. Increased Access to Credit

Some payment solutions also provide small businesses with access to business loans and other financing options. This can be particularly beneficial for small businesses that have limited access to traditional forms of credit, such as bank loans.

One way a payment solution can provide increased access to credit is by connecting small businesses with alternative lenders. These lenders may be more willing to provide loans to small businesses that may not qualify for traditional bank loans, based on factors such as credit score or business history. These alternative lending options can include online lenders, peer-to-peer lenders, and merchant cash advance providers.

Another way a payment solution can provide increased access to credit is by providing small businesses with tools to manage their cash flow. For example, a payment solution can provide small businesses with detailed reporting on their sales, expenses, and inventory levels, which can help them to identify patterns in their cash flow. This information can be used to help small businesses better plan for future expenses, such as inventory purchases, which can help them to avoid cash flow shortages.

Furthermore, some payment solutions also provide small businesses with the ability to use their future sales as collateral for loans, this is called a merchant cash advance, this can be helpful for small businesses that are looking for a quick way to access funds.

In summary, by providing small businesses with access to business loans and other financing options, a payment solution can help them to fund their operations and take advantage

10. Integration with other business tools

Many payment solutions can be integrated with other business tools such as accounting software, CRM, or e-commerce platforms. This can help small businesses to streamline their operations and automate their workflows, which can save them time and resources.

For example, a payment solution that is integrated with accounting software can automatically update financial records and reconcile transactions, which can help small businesses to save time and reduce errors. A payment solution that is integrated with a CRM can provide small businesses with customer information, such as purchase history, which can help them to personalize their customer service and improve customer loyalty. A payment solution that is integrated with an e-commerce platform can help small businesses to manage their online store, such as updating inventory levels and processing payments.

11. Compliance with regulations

A payment solution can help small businesses to comply with various regulations related to payments and data security, such as PCI DSS, HIPAA, and GDPR. This can help small businesses to reduce their liability and improve their reputation.

For example, a payment solution that provides small businesses with PCI DSS compliance can help them to protect sensitive customer information and prevent fraud. A payment solution that provides small businesses with HIPAA compliance can help them to protect sensitive patient information and prevent breaches. A payment solution that provides small businesses with GDPR compliance can help them to protect sensitive customer information and comply with data privacy regulations.

Key Benefits Of Using ExpoNovum As A Payment Solution For Small Business

ExpoNovum is a payment solution that is specifically designed for small businesses. Some key benefits of using ExpoNovum as a payment solution for small businesses include:

1. Easy Integration

ExpoNovum can be easily integrated with various business tools, such as point-of-sale systems, e-commerce platforms, and accounting software, which can help small businesses to streamline their operations and automate their workflows.

2. Secure Transactions

ExpoNovum uses advanced security features, such as encryption and tokenization, to protect sensitive customer information and prevent fraud.

3. Multiple Payment Options

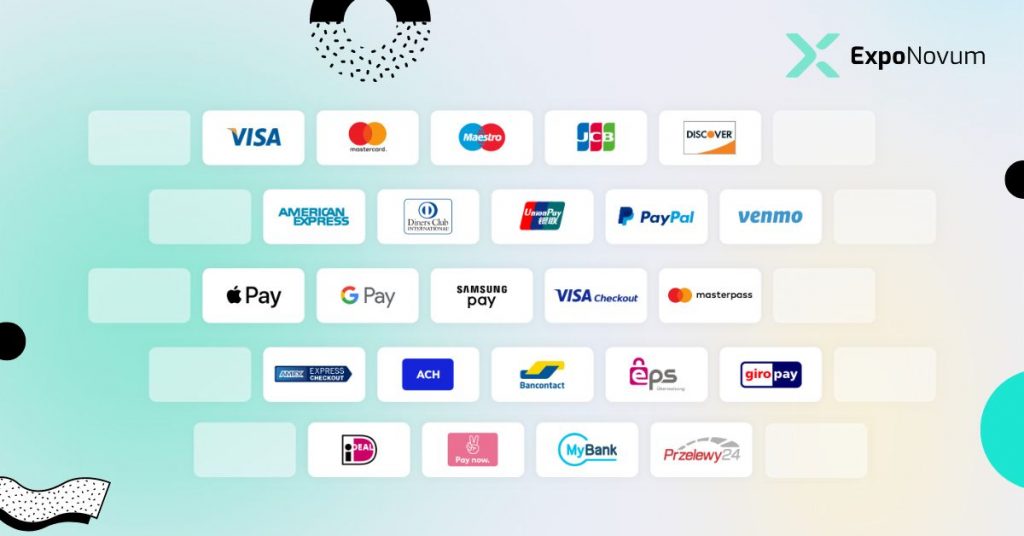

ExpoNovum supports various payment methods, including credit and debit cards, e-checks, and mobile payments, which can help small businesses to increase their customer base and sales.

4. Detailed Reporting

ExpoNovum provides small businesses with detailed reporting on their transactions, inventory levels, and employee hours, which can help them to manage their finances and track their sales.

5. Advanced Scalability

ExpoNovum provides small businesses with tools to manage multiple locations, employees, and sales channels, which can help them to scale their operations as they grow.

6. Compliance With Regulations

ExpoNovum helps small businesses to comply with various regulations related to payments and data security, such as PCI DSS, HIPAA, and GDPR, which can help small businesses to reduce their liability and improve their reputation.

7. 24/7 Support

ExpoNovum provides small businesses with a dedicated customer support team that can help them to set up and use the platform, as well as troubleshoot any issues that may arise.

How a Card Acquiring Company Can Help Your Business Thrive In 2023

Bottom Line

In conclusion, using a payment solution for small businesses can provide a wide range of benefits including increased efficiency, improved security, enhanced customer experience, and cost savings.

A payment solution can help small businesses to streamline the process of accepting payments, which can save them valuable time and resources. Additionally, a payment solution can provide small businesses with advanced security features, which can protect sensitive customer information and help them to prevent fraud.

Moreover, by providing customers with a variety of payment options, faster and more secure transactions, and personalized customer service, a payment solution can help small businesses to enhance the customer experience, which can lead to increased customer loyalty and repeat business.

Furthermore, a payment solution can also help small businesses to save money on transaction fees, equipment and supplies, and accounting and record-keeping expenses. This can help small businesses to improve their bottom line and increase their revenue.

For small business owners, it’s crucial to evaluate their business needs and choose a payment solution that best fits their requirements. It’s also important to implement the payment solution in a way that ensures compliance with regulations and maximizes security. With the right payment solution, small businesses can run their operations more efficiently and effectively, ultimately allowing them to better serve their customers and grow their business.