Introduction

Online security has become a top concern for consumers in recent years, with cybercrime and online fraud becoming more prevalent. With the growing number of online transactions, protecting personal and financial information has become a priority. That’s where Privacy.com 3D Secure comes in.

What is Privacy.com 3D Secure?

Privacy.com 3D Secure is a technology that adds an extra layer of security to online transactions, providing consumers with peace of mind while shopping online. In this article, we’ll delve into what Privacy.com 3D Secure is, how it works, and the benefits it offers to consumers.

To start, we’ll define Privacy.com 3D Secure and explain its purpose. Then, we’ll provide an overview of the article and the topics we’ll be covering. By the end of this chapter, readers will have a good understanding of what Privacy.com 3D Secure is and why it’s important.

In the following chapters, we’ll explore the technology in more detail, including how it works and the advantages it offers. We’ll also go over the steps involved in using Privacy.com 3D Secure for online transactions and how it can help protect personal and financial information.

3D Secure Technology

3D Secure technology is a security protocol used in online transactions to verify the cardholder’s identity. The technology was developed by major credit card companies to provide an extra layer of protection for online transactions.

How Privacy.com 3D Secure fits in

Privacy.com 3D Secure is a platform that utilizes 3D Secure technology to enhance the security of online transactions. It adds an extra layer of protection to online payments by requiring the cardholder to confirm their identity through a secure authentication process.

How Does Privacy.com 3D Secure Work?

Now we’ll take a closer look at how Privacy.com 3D Secure works to provide enhanced security for online transactions.

Steps involved in a 3D Secure transaction

- Cardholder initiates a transaction: The cardholder initiates a transaction with a participating merchant.

- Authentication request: The merchant sends an authentication request to the cardholder’s issuing bank, which determines whether the cardholder’s identity needs to be verified.

- Cardholder authentication: If the identity needs to be verified, the cardholder is redirected to a secure authentication page, where they are asked to enter a password or confirm their identity through a one-time code sent to their mobile phone.

- Authentication response: The issuing bank sends an authentication response to the merchant, indicating whether the cardholder’s identity has been successfully verified.

How Privacy.com 3D Secure adds an extra layer of security

Privacy.com 3D Secure adds an extra layer of security by requiring cardholders to confirm their identity before completing a transaction. This helps reduce the risk of fraud and protects personal and financial information.

Explanation of risk-based authentication

Risk-based authentication is a security method used by Privacy.com 3D Secure to determine the level of risk associated with a transaction. The platform uses advanced algorithms to assess the risk and determine whether the cardholder’s identity needs to be verified. If the risk is low, the transaction is approved without requiring authentication. If the risk is high, the cardholder is asked to confirm their identity before the transaction can be completed.

Setting up Privacy.com 3D Secure

Now let’s take a step-by-step approach to set up Privacy.com 3D Secure for online transactions.

A. Signing up for Privacy.com

- Creating an account: To use Privacy.com 3D Secure, you’ll need to create an account on the Privacy.com platform.

- Adding your card: You’ll need to add the card you want to use for online transactions to your Privacy.com account.

B. Using Privacy.com for online shopping/transactions

- Initiating a transaction: When making an online purchase with a participating merchant, you’ll be asked to choose Privacy.com as your payment method.

- Confirming your identity: You’ll be redirected to the Privacy.com 3D Secure authentication page, where you’ll need to verify your identity before the transaction can be completed.

C. Enhancing security with additional features

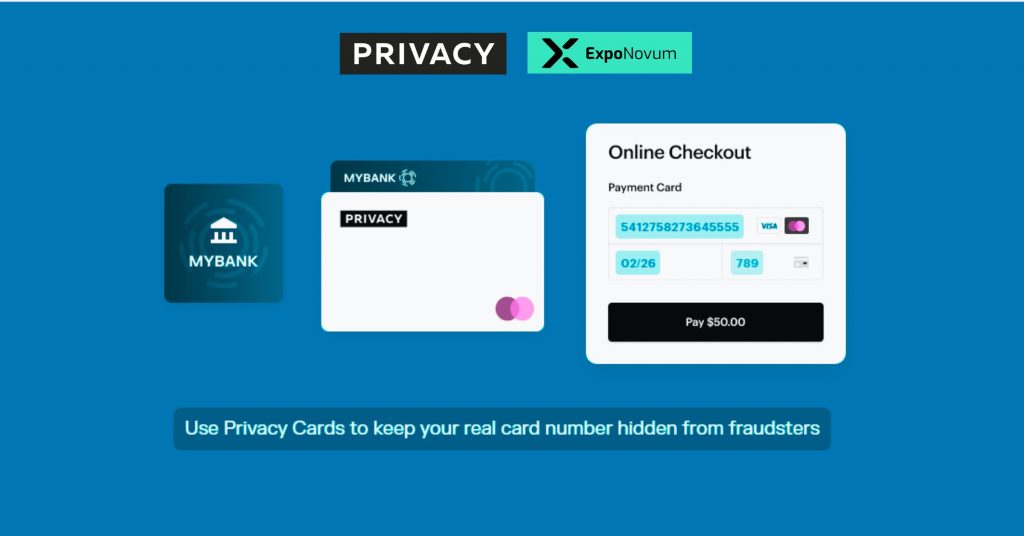

- Virtual card numbers: Privacy.com also offers virtual card numbers, which are unique numbers that can be used instead of your physical card number for online transactions.

- Two-factor authentication: You can also set up two-factor authentication for added security.

Benefits of Privacy.com 3D Secure

Reduced risk of fraud

By requiring cardholders to confirm their identity before completing a transaction, Privacy.com 3D Secure helps reduce the risk of fraud and protects personal and financial information.

(Learn the risks of shopping in non 3d secure sites)

Advanced risk assessment

Privacy.com 3D Secure uses advanced algorithms to assess the risk associated with transaction fees and determine whether the cardholder’s identity needs to be verified.

Easy setup

Setting up Privacy.com 3D Secure is easy and straightforward, and the platform is designed to be user-friendly.

Seamless transactions

The authentication process is quick and seamless, ensuring a smooth transaction experience for the physical/virtual card service.

No additional fees

Privacy.com 3D Secure is free to use and there are no additional fees involved.

No hardware or software required

The platform is accessible through a web browser, so there’s no need to install any hardware or software.

Masked card information

Privacy.com 3D Secure uses masked card information to protect the user’s personal and financial information.

Virtual card numbers

The option to use virtual card numbers further enhances the protection of personal information (e.g. email address) by creating a unique number for each transaction.

Mobile compatibility

Privacy.com 3D Secure is compatible with mobile devices, making it easy to use.

Cross-device functionality

The platform supports cross-device functionality, so users can access their accounts from any device with an internet connection.

Fast authentication

Privacy.com 3D Secure’s fast and seamless authentication process helps to speed up transactions, ensuring users don’t have to wait for long to complete their purchases.

Reduced risk of declined transactions

The advanced risk assessment algorithms used by Privacy.com 3D Secure help to reduce the risk of transactions being declined, further improving transaction speed.

Privacy.com Virtual Cards

Privacy.com is a virtual card service that offers a convenient and secure way to make online payments. As someone who values privacy and security when it comes to financial transactions, I was excited to try out this service.

One of the standout features of Privacy.com is the ability to create virtual cards for each transaction. This means that instead of using your actual credit or debit card number, you can generate a unique virtual card number for each purchase you make. This provides an additional layer of security, as your real card number is never shared with the merchant.

Creating a virtual card is incredibly easy. After signing up for an account, you simply select the amount you want to spend and the merchant you’re making the purchase from. Privacy.com then generates a virtual card number that you can use to make your purchase. You can set spending limits for each card and even set expiration dates if you want the card to be valid for a limited time.

Another great feature of Privacy.com is the ability to freeze and unfreeze your virtual cards at any time. If you lose your phone or suspect that your account has been compromised, you can quickly freeze your cards to prevent any unauthorized transactions.

In terms of security, Privacy.com uses bank-level encryption and security protocols to protect your information. They also offer two-factor authentication and the option to use biometric authentication (such as Touch ID or Face ID) to log into your account.

The service is not without its limitations, however. While Privacy.com is free to use, they do charge a fee for certain services, such as international transactions or for using a debit card to fund your account. Additionally, the service is only available in the United States at this time.

Overall, I have been very impressed with Privacy.com. The ability to create virtual cards for each transaction provides an added layer of security that gives me peace of mind when shopping online. The ease of use and robust security measures make this service a great choice for anyone looking to protect their financial information online.

Bottom Line

In conclusion, Privacy.com 3D Secure is a valuable tool for anyone looking to enhance the security of their online transactions. With its advanced risk assessment algorithms, fast and seamless authentication process, and user-friendly design, this platform offers a cost-effective solution for protecting personal and financial information. From the convenience of using virtual card numbers to the ability to access accounts from any device, Privacy.com 3D Secure offers a comprehensive solution for online security.

Whether you’re making a purchase on your computer, tablet, or mobile phone, Privacy.com 3D Secure provides peace of mind and helps ensure the security of your transactions. With the increasing number of online transactions, it’s more important than ever to protect your personal and financial information. By understanding the features and benefits of Privacy.com 3D Secure, you’ll be able to make an informed decision about how to safeguard your information (e.g. email address) and feel confident when shopping online.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.