What is the Automated Clearing House (ACH)?

The Automated Clearing House (ACH) is a secure electronic network that facilitates funds transfer between financial institutions. It is widely used to process various transactions, including direct deposit of payroll and Social Security benefits, automatic bill payments, e-checks, and other types of payments.

The ACH network is managed by the National Automated Clearing House Association (NACHA) and is overseen by the Federal Reserve. It is designed to be an efficient, cost-effective, and secure method of electronic funds transfer, making it a popular option for many businesses, individuals, and government agencies.

Overall, the ACH network is a reliable, efficient, and secure way to move money between bank accounts. It is widely used across the United States. It is a cost-effective method of electronic funds transfer, making it a popular option for businesses, individuals, and government agencies.

What is an ACH Transfer?

An ACH transfer (Automated Clearing House) is an electronic funds transfer that uses the ACH network to move money between bank accounts. ACH transactions are processed in batches, meaning they are not processed in real time. ACH transactions include Direct deposit of payroll and Social Security benefits, Automatic bill payments, e-checks, and other types of payments.

The transactions are processed by the ACH operator and settled through the Federal Reserve or the Clearing House Interbank Payments System (CHIPS). The bank account information is used to identify the sender and the recipient of the funds, and the routing number ensures the funds are directed to the correct financial institution.

Unlike wire transfers, which are processed in real-time, ACH transactions are processed in batches, meaning they take a bit longer to clear, typically 2-3 business days. This allows for a lower cost than wire transfers and the ability to process a high volume of transactions. The ACH network also provides security measures to protect against fraud and unauthorized transactions.

ACH transactions are typically less expensive than wire transfers. They are considered secure methods of electronic funds transfer, but they take longer to process, typically 2-3 business days.

Different Types of ACH Transfers

There are several types of ACH transfers, including:

- ACH direct debit: where a consumer authorizes a merchant to withdraw funds from their account for a specific transaction or recurring payments.

- ACH direct credit: where a consumer or business initiates funds transfer to another account.

- ACH recurring credit/debit: where a consumer or business authorizes recurring payments or transfers.

- ACH one-time credit/debit: where a consumer or business initiates a single transfer of funds.

Overall, ACH is a reliable and cost-effective way to move money electronically. It has been widely adopted by businesses, financial institutions, and government agencies to facilitate various transactions and payments.

ACH Debit vs ACH Credit

ACH debit and credit are transactions processed through the Automated Clearing House (ACH) network. They both use the ACH network to move funds between bank accounts, but the main difference between them is the direction of the fund’s transfer:

ACH debit: ACH debit transactions are used to withdraw funds from a bank account to pay bills, make purchases, or transfer funds to another account. They are typically initiated by the payee, such as a merchant or utility company, and require the account holder’s authorization. You can process ACH debit transactions for one-time or recurring payments.

ACH credit: ACH credit transactions deposit funds into a bank account. The payer, such as an employer, government agency, or other financial institution, typically initiates them. They do not require the account holder’s authorization. You can process ACH credit transactions for one-time or recurring payments, such as payroll deposits, social security benefits, and pension payments.

In summary, ACH debit transactions withdraw money from an account, while ACH credit transactions deposit money into an account. Both ACH transactions can be processed for one-time or recurring payments and are subject to daily and monthly transaction limits.

ACH Transfer Timelines

One of the most important considerations when using ACH transfers is understanding the timeline for when the funds will be available in the recipient’s account. This chapter will overview how long ACH transfers typically take and discuss standard ACH transfer timelines and Same Day ACH transactions.

When Do ACH Payments Post

Typically, ACH payments post in 1-3 business days to clear. This means that the funds will be available in the recipient’s account on the third business day after the transfer was initiated. However, it is essential to note that some banks may have different processing times, so it is always best to check with your bank for specific details.

Standard ACH Transfer Timelines

- Day 1: The transfer is initiated by the sender’s bank

- Day 2: The transfer is processed by the Federal Reserve

- Day 3: The funds are available in the recipient’s account

It’s essential to remember that these are just standard timelines, and some banks may have different processing times.

Same-Day ACH Transactions

In 2016, the National Automated Clearing House Association (NACHA) introduced Same Day ACH Transactions. This allows for faster processing of ACH transactions and makes funds available in the recipient’s account on the same day as the transfer. This is particularly useful for businesses that need to make urgent payments or for consumers who need to transfer funds quickly in emergencies.

Reasons Why ACH Transfers Are Not Instant

While Same Day ACH Transactions have increased the speed of ACH transfers, it is still not an instant transfer of funds. This is because ACH transfers rely on a batch processing system, where a group of transactions is processed at specific times throughout the day. This is done to ensure the security and accuracy of the transactions. Additionally, ACH transfers also rely on the availability and processing times of the recipient’s bank.

Overall, ACH transfers are a reliable and cost-effective way to move money electronically. Still, it is essential to keep in mind the timeline for when the funds will be available. Standard ACH transfers take 1-3 business days to clear, while the Same Day ACH transactions are available on the same day as the transfer. However, it is essential to note that ACH transfers are not instant and are subject to the availability and processing times of the recipient’s bank.

How ACH Transfers Work

This chapter will explain how ACH transfers work, including a rundown of the ACH transfer process and an overview of any limitations of ACH transfers.

Rundown of the ACH Transfer Process

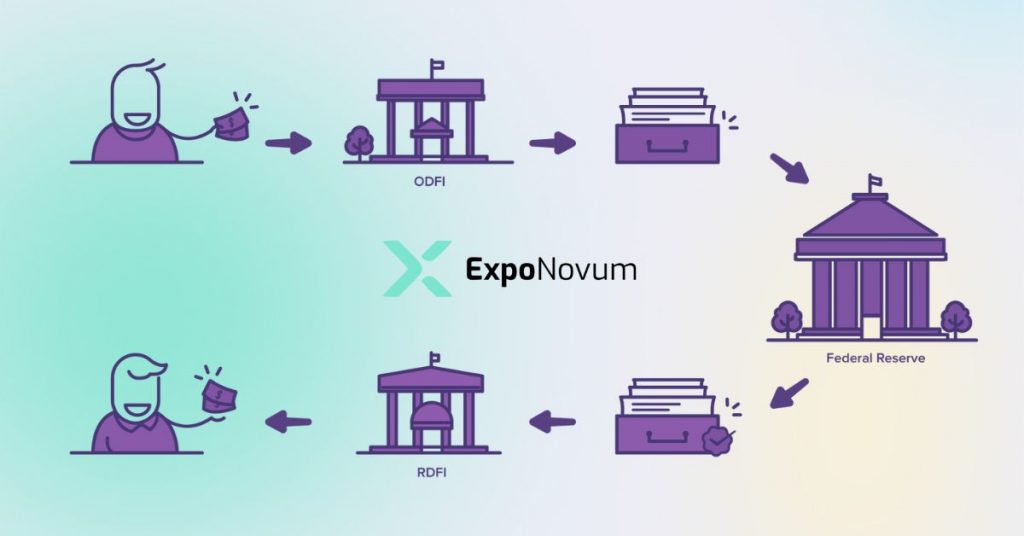

- The sender initiates the transfer by providing their bank with the recipient’s account information and the amount to be transferred.

- The sender’s bank sends the transfer information to the Federal Reserve, which acts as a clearinghouse for ACH transactions.

- The Federal Reserve forwards the transfer information to the recipient’s bank.

- The recipient’s bank credits the funds to the recipient’s account.

It’s essential to remember that ACH transfers are processed in batches, meaning that a group of transactions is processed together at specific times throughout the day. This is done to ensure the security and accuracy of the transactions.

Overall, ACH transfers move funds electronically from one bank account to another via the Federal Reserve. The process is secure and cost-effective, but it is not instant and subject to the availability and processing times of the recipient’s bank.

Additionally, specific limitations and security measures are in place to ensure the integrity of the transactions.

Steps Involved In An ACH Transfer

This chapter will explain the steps involved in an ACH transfer, from initiation to completion.

Initiating The Transfer

The first step in an ACH transfer is for the sender to initiate the transfer by providing their bank with the recipient’s account information and the amount to be transferred. This can be done online, over the phone, or in person. The sender will also need to provide their account information, including their account number and routing number.

Verifying Account Information

Once the sender has provided the necessary information, the bank will verify the accuracy of the account information provided. This includes ensuring that the recipient’s account number and routing number are correct and that the sender has sufficient funds in their account to complete the transfer.

Processing The Transfer

The bank will then process the transfer by sending the transfer information to the Federal Reserve, which acts as a clearinghouse for ACH transactions. The Federal Reserve will then forward the transfer information to the recipient’s bank.

Depositing The Funds

The recipient’s bank will then credit the funds to the recipient’s account. This is typically done on the third business day after the transfer was initiated.

Completing The Transfer

The final step in an ACH transfer is for the recipient to receive the funds in their account and for the sender to confirm that the transfer has been completed. The recipient needs to check their account balance to ensure that the funds have been credited. Once the transfer is complete, the sender and recipient will receive confirmation from their respective banks.

Additional Steps

Depending on the specific circumstances, additional steps may be involved in an ACH transfer. For example, suppose the transfer is for a recurring payment or subscription. In that case, the sender may need to authorize the recurring payments in advance. Additionally, the transfer is for a significant amount. In that case, the bank may require additional verification or documentation to ensure the security of the transaction.

Overall, the steps involved in an ACH transfer include the following:

- Initiating the transfer by providing account information.

- Verifying account information.

- Processing the transfer through the Federal Reserve.

- Depositing the funds in the recipient’s account.

- Completing the transfer with confirmation from the banks.

Additional steps may be required depending on the specific circumstances of the transfer. It’s essential for individuals and businesses to carefully follow the steps involved in an ACH transfer to ensure the accuracy and security of the transaction.

ACH Transfer Safety

This chapter will discuss the safety measures to protect against fraud and unauthorized transactions in ACH transfers. It will also provide examples of ACH fraud and how to protect against it.

ACH Security Measures

To ensure the security of ACH transactions, the Federal Reserve and financial institutions use various security measures such as encryption and authentication to protect sensitive information. Additionally, ACH transactions are subject to the rules and regulations of the Federal Reserve and NACHA to prevent fraud and unauthorized transactions.

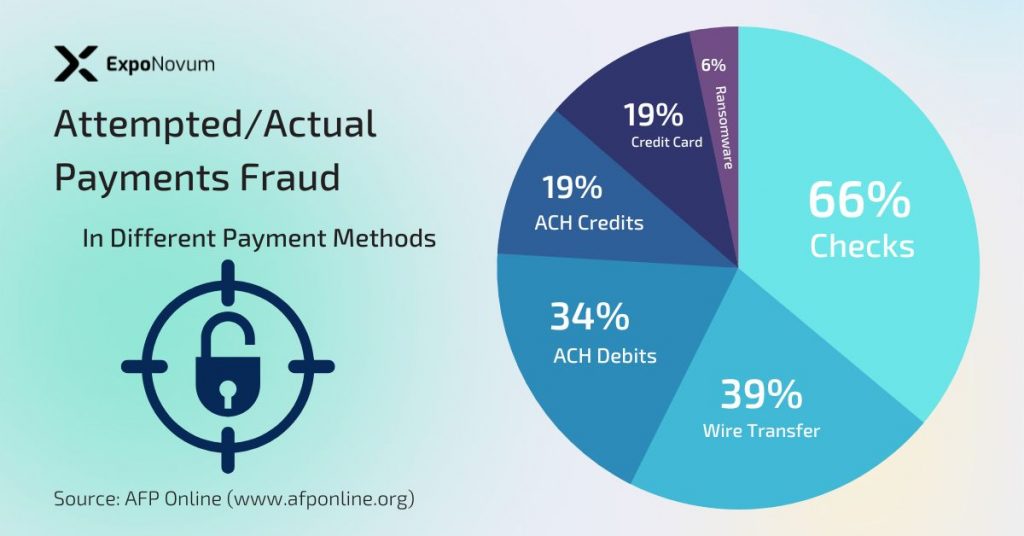

Examples of ACH Fraud

- Phishing Scams: Scammers may use emails or text messages to trick individuals into providing their account information, which can then be used to initiate unauthorized ACH transfers.

- Unauthorized ACH Debits: A scammer obtains an individual’s account information and initiates unauthorized ACH debit transactions.

- Business Email Compromise (BEC): This occurs when scammers gain access to a business’s email account and use it to initiate unauthorized ACH transfers.

How to Protect Against ACH Fraud

Keep your account information private: Do not share your account information with anyone unless you initiate the transaction.

Be wary of unsolicited emails or text messages: Be suspicious of unsolicited emails or texts asking for your account information.

Review your bank statements regularly: Review your bank statements regularly and report any unauthorized transactions to your bank.

Use two-factor authentication: Use two-factor authentication to protect your account information and keep it secure.

Use anti-virus software: Use anti-virus software to protect your computer and mobile devices from malware.

Overall, ACH transfers are secure and protected by various security measures, including encryption, authentication, and regulations from the Federal Reserve and NACHA. However, ACH fraud, such as phishing scams, unauthorized ACH debits, or Business Email Compromise (BEC), can still occur.

It’s essential to keep your account information private to protect yourself from ACH fraud, be wary of unsolicited emails or text messages, review your bank statements regularly, use two-factor authentication, and use anti-virus software.

ACH Transfers vs Wire Transfers

In this chapter, we will compare ACH transfers and wire transfers, discussing the similarities and differences and the pros and cons of each.

Similarities Between ACH Transfers And Wire Transfers

- ACH and wire transfers are used to move funds electronically from one bank account to another.

- Both transfers are initiated by the sender, who provides their bank with the recipient’s account information and the amount to be transferred.

- ACH and wire transfers are subject to regulations and security measures to protect against fraud and unauthorized transactions.

Differences Between ACH Transfers And Wire Transfers

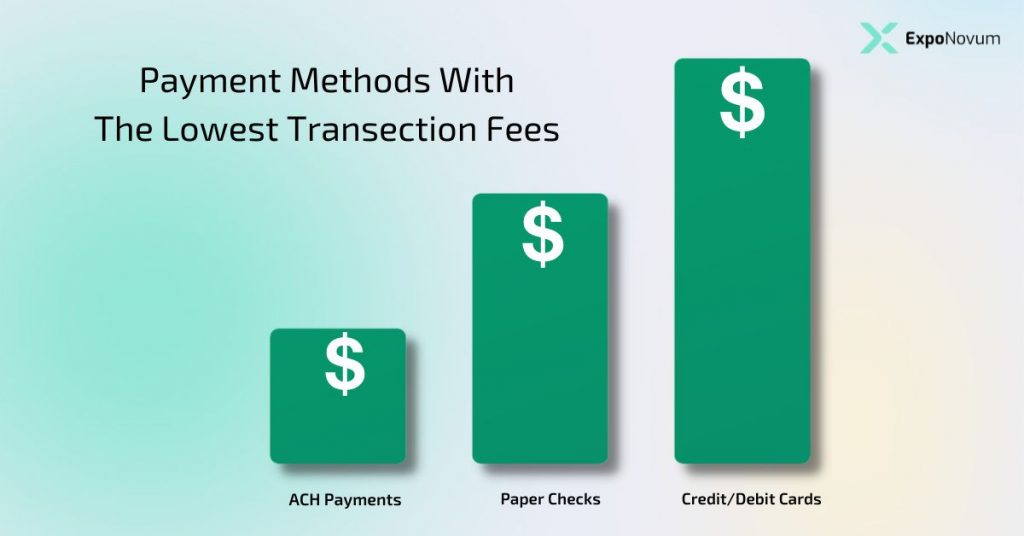

- ACH transfers typically take 1-3 business days to clear, while wire transfers are generally processed on the same day.

- ACH transfers have lower transaction limits compared to wire transfers.

- Wire transfers typically have higher fees than ACH transfers.

- Wire transfers are more commonly used for international transactions, while ACH transfers are primarily used for domestic transactions.

Pros and Cons of ACH Transfers

- Pros: ACH transfers are typically faster and less expensive than traditional paper check transactions; they have lower transaction limits and are widely used for domestic transactions.

- Cons: ACH transfers are not instant and typically take 1-3 business days to clear.

Pros and Cons of Wire Transfers

- Pros: Wire transfers are generally processed on the same day and are commonly used for international transactions.

- Cons: Wire transfers typically have higher fees than ACH transfers and have higher transaction limits.

Which Is Faster, ACH or Wire Transfer

Wire transfers are generally faster than ACH transfers. A wire transfer is an electronic transfer of funds typically completed within a few hours or, at most, a day. This is because wire transfers are processed in real-time, meaning the funds are immediately debited from the sender’s account and credited to the recipient’s account.

On the other hand, an ACH transfer can take several days to clear. An ACH transfer is processed through the Automated Clearing House (ACH) network, which batches transactions together and processes them in batches. ACH transactions are not processed in real-time like wire transfers, which is why it takes a bit longer for the funds to clear.

A standard ACH transfer typically takes 2-3 business days to clear. A VIP ACH transfer is faster than a standard ACH, but it’s still slower than a wire transfer and typically takes a day or two to clear.

eCheck vs ACH Debit

In this chapter, we will compare eChecks and ACH debits, discussing the similarities and differences and the pros and cons of each.

Similarities Between eCheck And ACH Debit

- EChecks and ACH debits are electronic payments processed through the Automated Clearing House (ACH) network.

- Both eChecks and ACH debits withdraw funds from the payer’s account and deposit them into the payee’s account.

- Both eChecks and ACH debits are subject to regulations and security measures to protect against fraud and unauthorized transactions.

Differences Between eCheck And ACH Debit

- eChecks are typically used for one-time payments, while ACH debits are typically used for recurring payments or subscriptions.

- eChecks require the payer to enter their account information manually. At the same time, ACH debits can be set up for recurring payments with the payer’s authorization.

- eChecks are often used by businesses to process payments through merchants often use ACH debits used by merchants for in-person or online transactions.

Pros and Cons of eChecks

- Pros: eChecks are a cost-effective way for business. They cancel payments and can be easily integrated into a website or shopping cart.

- Cons: eChecks require manual entry of account information and are typically used for one-time payments.

Pros and Cons of ACH Debit

- Pros: ACH debits can be set up for recurring payments, reducing the need for manual entry of account information.

- Cons: ACH debits are typically used for recurring payments, making it difficult to cancel or modify a payment.

In summary, eChecks and ACH debits are payments processed through the ACH network. Both eChecks and ACH debits have similarities and differences, eChecks are typically used for one-time payments, while ACH debits are typically used for recurring payments or subscriptions.

eChecks are cost-effective for businesses but require the payer to enter their account information manually. At the same time, ACH debits can be set up for recurring payments with the payer’s authorization. It’s essential for individuals and businesses to carefully consider their specific needs and choose the appropriate type of transfer for their financial transactions.

Direct Deposit vs ACH Debit

In this chapter, we will compare Direct Deposit and ACH debit, discussing the similarities and differences and the pros and cons of each.

Similarities Between Direct Deposit and ACH Debit

- Direct Deposit and ACH debit are electronic payments processed through the Automated Clearing House (ACH) network.

- Both Direct Deposit and ACH debit deposit funds into the recipient’s account.

- Direct Deposit and ACH debit are subject to regulations and security measures to protect against fraud and unauthorized transactions.

Differences Between Direct Deposit and ACH Debit

- Direct deposit is typically used for the deposit of payroll or government benefits. In contrast, ACH debit is typically used for recurring payments or subscriptions.

- Direct deposit requires the recipient to provide their account information to their employer or government agency. In contrast, ACH debit requires the payer to authorize recurring payments to a merchant.

- Direct deposit is a one-way transaction. ACH debit can also be used for ACH credit transactions where funds are transferred from the merchant’s account to the consumer’s.

Pros and Cons of Direct Deposit

- Pros: Direct Deposit is a convenient and secure way to receive payroll or government benefits. It eliminates the need to wait for paper checks to clear and eliminates the risk of lost or stolen checks.

- Cons: Direct Deposit requires the recipient to provide their account information to their employer or government agency.

Pros and Cons of ACH Debit

- Pros: ACH debit allows recurring payments or subscriptions, which can be convenient for merchants and consumers.

- Cons: ACH debit requires the payer to authorize recurring payments to a merchant, making it difficult to cancel or modify a payment.

In summary, Direct Deposit and ACH debit are electronic payments processed through the ACH network. Direct Deposit and ACH debit have similarities and differences; Direct deposit is typically used for the deposit of payroll or government benefits, while ACH debit is typically used for recurring payments or subscriptions.

Direct deposit is a convenient and secure way to receive payroll or government benefits. Still, the recipient must provide their account information to their employer or government agency. ACH debit allows recurring payments or subscriptions, which can be convenient for merchants and consumers. Still, it requires the payer to authorize recurring payments to a merchant, making it difficult to cancel or modify a payment.

It’s essential for individuals and businesses to carefully consider their specific needs and choose the appropriate type of transfer for their financial transactions. Additionally, it’s also important to note that ACH debit is a one-way transaction, while ACH credit transactions are when funds are transferred from the merchant’s account to the consumer’s account.

ACH Fees and Cost

This chapter will discuss the fees associated with ACH transfers and how they can affect costs.

Types of ACH Fees

- Origination Fees: These are fees charged by the sender’s bank for initiating an ACH transfer.

- Receiving Fees: These are fees charged by the recipient’s bank for receiving an ACH transfer.

- Return Fees: These are fees charged by the sender’s bank if an ACH transfer is returned or rejected.

- Same-Day Fees: Some banks charge additional fees for processing same-day ACH transfers.

Factors that Affect the Cost of ACH Fees

- The amount of the transfer: ACH transfer fees are often based on a percentage of the transfer amount so larger transfers can result in higher fees.

- The frequency of transfers: For businesses, the cost of ACH transfer fees can be affected by the frequency of transfers. For example, a business that processes many small transactions daily may incur higher fees than a business that processes fewer, more significant transactions.

- The type of account: Some banks may offer different pricing structures for different types of accounts, such as business or personal accounts.

How to Reduce ACH Fees

Compare pricing

Compare pricing from different banks to find the best deal for your needs.

Negotiate with your bank

Some banks may be willing to negotiate lower fees for large volumes or frequent transfers.

Use a third-party service

Some services may offer lower fees than traditional banks.

Choose the correct type of transfer

Consider using wire transfers for large or time-sensitive transfers, as they typically have higher fees but can be processed more quickly than ACH transfers.

In summary, ACH transfers come with associated fees, such as origination, receiving, return, and same-day fees. The cost of these fees can be affected by the amount of the transfer, the frequency of transfers, and the type of account.

To reduce the cost of ACH fees, individuals and businesses can compare pricing from different banks, negotiate with their bank, use a third-party service, or choose the right type of transfer for their specific needs.

Benefits Of ACH Payments For Businesses

This chapter will discuss the advantages of using ACH for businesses, including cost savings, convenience, and security.

Cost Savings

ACH transactions are typically less expensive than paper check transactions, as they eliminate the need for printing and mailing costs.

ACH payments can also help businesses reduce the cost of processing returns and late payments.

Some businesses can negotiate lower fees with their bank for large volumes or frequent ACH transactions.

Convenience

ACH transactions can be processed quickly and efficiently, reducing the need for manual data entry and the chance of errors.

ACH payments can also be set up for recurring payments or subscriptions, saving businesses time and reducing the need for manual billing processes.

ACH can also be integrated into business websites or shopping carts, allowing customers to make payments directly from the website.

Security

ACH transactions are subject to regulations and security measures to protect against fraud and unauthorized transactions.

By using ACH, businesses can reduce their risk of fraud and protect their customers’ financial information.

ACH also allows for easy tracking and reconciliation of transactions, which can help businesses detect and prevent fraud.

Improved cash flow

ACH allows for automatic payments for businesses, which can help improve cash flow and make it easier for businesses to manage their finances.

It also allows for the automatic deposit of payroll or government benefits, which can help businesses manage their finances more efficiently.

Increased automation

By using ACH, businesses can automate many financial processes, such as payments, invoicing, and collections, saving significant time and resources.

Improved customer experience

ACH payments can improve the customer experience by providing customers with more payment options, such as online and recurring payments, which can increase customer satisfaction and loyalty.

Increased accuracy

ACH payments can increase accuracy by eliminating the need for manual data entry and reducing the chance of errors. This can lead to fewer disputes and chargebacks, saving businesses time and money.

Better cash management

ACH payments can help businesses better manage their cash flow by allowing them to collect payments automatically and make payments on schedule. This can help businesses budget more effectively and avoid cash flow problems.

Greater scalability

ACH payments can quickly scale to meet the needs of businesses of all sizes. Whether a business is processing a few transactions a month or thousands, ACH can handle the volume.

Better tracking and reporting

ACH payments provide businesses with detailed tracking and reporting capabilities, which can help them better understand their financial performance and make more informed decisions.

ACH has many business benefits, including cost savings, convenience, security, and improved cash flow. ACH transactions are typically less expensive than paper check transactions, can be processed quickly and efficiently, and are subject to regulations and security measures to protect against fraud.

ACH payments can also be set up for recurring payments or subscriptions, saving businesses time and reducing the need for manual billing processes. It can be integrated into business websites or shopping carts, allowing customers to make payments directly from the website. Additionally, ACH can help businesses improve their cash flow and manage their finances more efficiently.

Limitations of ACH Transfers

This chapter will discuss the limitations of ACH transfers, including processing time, transaction limits, and potential for fraud.

Processing Time

- ACH transfers typically take 2-3 business days to process, which can be longer than other electronic transfers, such as wire transfers.

- This can be a limitation for businesses that need to transfer funds quickly or for individuals with urgent financial needs.

- Same Day ACH transactions are available, but it depends on the banks, and all financial institutions do not support it.

Transaction Limits

- ACH transactions are subject to transaction limits, which can vary depending on the bank and the type of account.

- These limits can be a limitation for businesses that need to transfer large amounts of money or for individuals with high-value transactions.

- Some financial institutions may offer higher limits for specific accounts, such as business or high-net-worth accounts.

Potential for Fraud

- ACH transactions are subject to the same types of fraud as other electronic payments, such as phishing and account takeover.

- Businesses and individuals should protect themselves from fraud by monitoring their accounts and not sharing personal or financial information with unknown parties.

Limited Transaction types

- ACH transfers are typically used for recurring payments, direct deposits, and e-checks. It can’t be used for instant payments or international transactions.

- This can be a limitation for businesses that need to make instant payments or transfer funds internationally.

Overall, ACH transfers have some limitations, including processing time, transaction limits, and potential for fraud. ACH transfers take longer than other electronic transfers, such as wire transfers. ACH transactions are subject to transaction limits, which can vary depending on the bank and the type of account.

ACH transactions are subject to the same types of fraud as other electronic payments, such as phishing and account takeover. Businesses and individuals should be aware of these limitations and take steps to protect themselves from fraud.

So it’s essential for businesses and individuals to carefully consider their specific needs and choose the appropriate type of transfer for their financial transactions.

Who Accepts ACH Payments Online?

Many online businesses and e-commerce websites accept ACH payments. ACH payments are a popular form of electronic payment and can be used for a wide variety of transactions, including online purchases, bill payments, and money transfers. Some examples of online businesses that accept ACH payments include:

- Online retailers, such as Amazon, Etsy, and Walmart

- Digital content providers, such as Netflix, Spotify, and iTunes

- Online marketplaces, such as eBay and Craigslist

- Online travel booking sites, such as Expedia and Priceline

- Online lending platforms, such as Lending Club and Prosper

- Online invoicing and accounting software, such as QuickBooks and FreshBooks

- Online fundraising platforms, such as Kickstarter and GoFundMe

It’s also worth noting that many businesses that have a website or mobile app may also accept ACH payments, so it’s always best to check with the company directly to see if they accept ACH payments.

Also, many banks and financial institutions offer the ability to pay bills online via ACH, this could be for mortgages, utilities, credit cards, etc.

Frequently Asked Questions

What is the difference between ACH and wire transfers?

ACH transfers are electronic payments processed through the Automated Clearing House (ACH) network. They typically take 2-3 business days to process and are subject to transaction limits. On the other hand, wire transfers are processed through a network of banks and typically take 24 hours or less to process. They also have higher transaction limits than ACH transfers.

Are ACH transfers safe?

ACH transfers are subject to regulations and security measures to protect against fraud and unauthorized transactions. However, businesses and individuals should protect themselves from fraud by monitoring their accounts and not sharing personal or financial information with unknown parties.

Can ACH transfers be expedited?

Yes, the Same Day ACH transactions are available. Still, it depends on the banks, and all financial institutions do not support it.

Can ACH transfers be used for international transactions?

No, ACH transfers are typically used for domestic transactions.

What are the transaction limits for ACH transfers?

ACH transaction limits can vary depending on the bank and the type of account. Some financial institutions may offer higher limits for specific accounts, such as business or high-net-worth accounts.

Can I cancel or modify an ACH transfer?

You can cancel or modify an ACH transfer by contacting your bank. Still, it’s not always possible, mainly if the transfer has already been processed.

Are there any fees associated with ACH transfers?

Yes, ACH transactions can incur origination, receiving, return, and same-day fees.

What time of day are ACH transactions posted?

The timing of ACH transaction posting can vary depending on the financial institution. Some banks may post ACH transactions as soon as they are received, while others may batch them and post them at a specific time. Typically, ACH transactions are processed and posted overnight to be available in the recipient’s account the next business day. However, checking with your bank to confirm their specific posting schedule for ACH transactions is best.

Do ACH transfers take three days to process?

ACH transfers typically take 2-3 business days to process, although this can vary depending on the financial institution. Some banks may process ACH transactions more quickly, while others may take longer. Additionally, the processing time can be affected by factors such as holidays, weekends, and the volume of transactions. However, the Same Day ACH transactions are available but not supported by all financial institutions. It’s best to check with your bank to confirm their specific processing time for ACH transactions. It’s essential to remember that ACH transactions are typically slower than other electronic transfers, such as wire transfers, which typically take 24 hours or less to process.

Can you speed up the ACH payment?

There are a few ways to speed up the processing time of ACH payments:

- Same Day ACH Transactions: Some banks offer Same Day ACH Transactions, which can be processed and posted on the same day. However, this service is not supported by all financial institutions.

- Wire Transfers: For large or time-sensitive transfers, wire transfers can be faster than ACH transfers as they typically take 24 hours or less to process.

- Contacting your bank: You can contact your bank to inquire about expediting an ACH transfer, although this may not always be possible, mainly if the transfer has already been processed.

- Using a third-party service: Some third-party payment processors may offer faster processing times for ACH transactions than traditional banks.

It’s important to note that while these options can speed up the processing time of ACH payments, they may also come with added costs or limitations. It’s best to check with your bank or third-party service provider for more information on the availability and cost of expediting ACH payments.

What is an ACH routing number?

An ACH routing number is a nine-digit code used to identify the financial institution used for an Automated Clearing House (ACH) transfer. It is also an ABA number or routing transit number (RTN). The routing number ensures the funds are transferred to the right bank and account. The routing number is usually located at the bottom of a check or can be obtained by contacting the financial institution. The routing number is used to identify the financial institution used for the ACH transfer. It helps to ensure that the funds are transferred to the right bank and account.

How do I find my ACH routing number?

You can find your ACH routing number in a few ways:

- Check your chequebook: The routing number is typically printed at the bottom, along with your account number and cheque number.

- Online banking: You can log in to your online banking account and find the routing number in the account or transaction information section.

- Contact your bank: You can contact your bank directly and ask for your routing number. They will be able to provide you with the information you need.

- Search the Federal Reserve Bank Routing Number Lookup: you can use the Federal Reserve Bank’s routing number lookup tool to find your routing number.

It’s important to note that banks can have multiple routing numbers, one for ACH and one for wire transfer. Make sure you use the correct routing number for the transaction you want to make. It’s also important to double-check the routing number before providing it to any party to avoid making payments to the wrong financial institution.

How can I set up ACH payments?

To set up ACH payments, you must provide your bank with the recipient’s account information and the transfer amount. This can typically be done in one of the following ways:

- Online: Many banks offer online banking platforms that allow you to set up ACH payments. You will need to log in to your account and navigate to the appropriate section to set up a new ACH payment.

- Over the phone: You can contact your bank and set up an ACH payment over the phone with a customer service representative. They will guide you through the process and provide the necessary information to complete the transaction.

- In-person: You can visit your bank’s local branch and set up an ACH payment with a representative. They will assist you with the process and provide the information you need to complete the transaction.

- Third-party providers: Some third-party providers offer ACH payment services that allow you to set up and manage ACH payments through their platform.

Before you set up an ACH payment, you may need to provide your bank with personal and financial information, such as your routing number, account number, and personal identification information. It’s also important to check with your bank for any specific requirements or procedures they may have for setting up ACH payments.

What is an ACH company ID?

An ACH company ID is a unique identifier assigned to a business or organization used to identify the company when making Automated Clearing House (ACH) transactions. The company ID is typically a number that is assigned by the financial institution or the ACH network and is used in conjunction with the routing number to ensure that the funds are transferred to the correct company.

The financial institution uses the ACH company ID to identify the company in ACH transactions. This helps to ensure that the funds are transferred to the correct company, and it also aids in the tracking and reporting of the transactions. It is usually required when setting up ACH transactions, such as direct deposit and recurring payments. The company ID is typically a number that is assigned by the financial institution or the ACH network.

Do ACH Payments Post On Weekends?

ACH payments typically do not post on weekends. The Automated Clearing House (ACH) network, which processes electronic payments, operates on a weekday schedule, with transactions being processed and settled on weekdays only (Monday through Friday). This means that if you initiate an ACH payment on a weekend, it will not be processed until the next business day.

However, there are some variations and exceptions, as some financial institutions may have different processing schedules for ACH payments, and some banks may process ACH payments on weekends or holidays. It’s best to check with your bank or financial institution for their specific ACH processing schedule.

Can ACH Payments Be Reversed?

Yes, ACH payments can be reversed under certain circumstances. This process is called a “reversal”. It can be initiated by the bank that processed the original payment, the bank that received the payment, or the company that initiated the payment. In order for a reversal to be processed, the bank or company must submit a request to the bank that processed the original payment, and the request must include the reason for the reversal.

Common reasons for reversing ACH payments include errors in the payment amount or account information, fraud, or disputes between the parties involved in the transaction. It’s important to note that the ACH reversal process can take several days and there may be fees associated with it.

Very nice post. I just stumbled upon your blog and wanted to say that I’ve really enjoyed browsing your blog posts. In any case I’ll be subscribing to your feed and I hope you write again soon!